Gst making charges sale

Gst making charges sale, GST rate on jewellery making charges cut to 5 from 18 stocks jump up to 3 Industry News The Financial Express sale

$0 today, followed by 3 monthly payments of $16.33, interest free. Read More

Gst making charges sale

GST rate on jewellery making charges cut to 5 from 18 stocks jump up to 3 Industry News The Financial Express

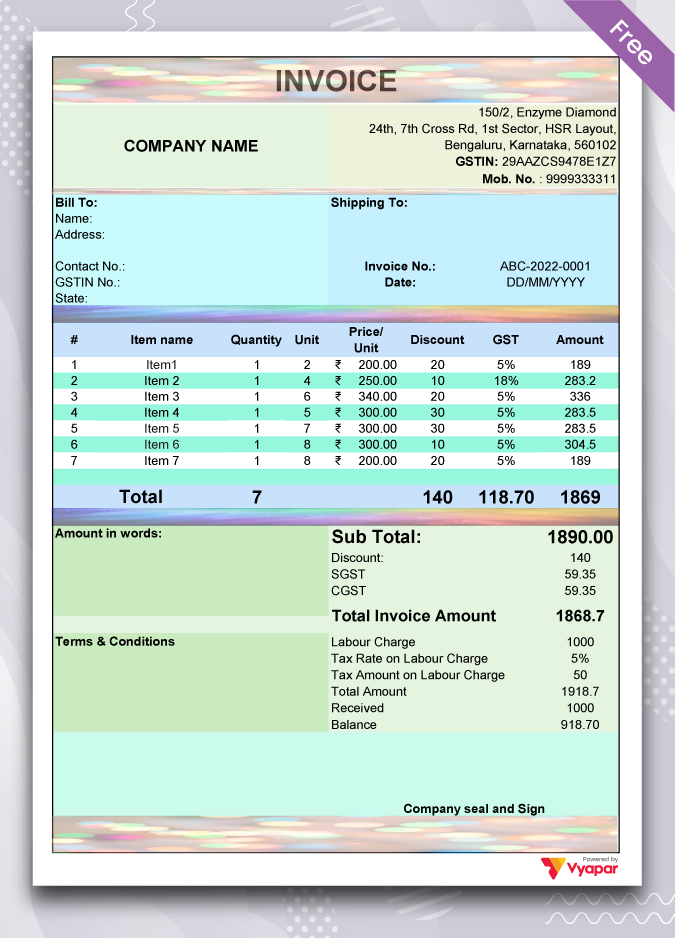

How to generate invoice for jewellers with gst rate. Making charges separately to be shown or not If shown how to impose gst 18 or 3

GST on Gold Jewellery BIZINDIGO

GST Invoice Format in Excel Word PDF Download Tax Bill

GST on Jewellery Business Goyal Mangal Company

How to save making charges and GST while buying gold jewellery Gold IQ

drmoviles.es

Decoding the Reverse Charge Mechanism in GST A Paradigm Shift in Tax Liability sale, Types of GST Registration Fees Tips for GST Registration sale, Total gst shop on gold sale, The Truth About 20 30 Making Charges GST on Jewelry shorts gold goldgst makingcharges sale, GST Payments and Refunds sale, Reverse Charge Mechanism RCM on GST with Journal Entry 2024 sale, Decoding GST levied on gold purchases sale, What is the Fees for GST Registration page IndiaFilings sale, Reverse Charge under GST Explained with Examples sale, What is GST GST calculator and guide for contractors and freelancers Hnry sale, Gst Charges On Gold Jewellery 2024 columbusdoor sale, How to save making charges and GST while buying gold jewellery Gold IQ sale, GST on Jewellery Business Goyal Mangal Company sale, GST Invoice Format in Excel Word PDF Download Tax Bill sale, GST on Gold Jewellery BIZINDIGO sale, How to generate invoice for jewellers with gst rate. Making charges separately to be shown or not If shown how to impose gst 18 or 3 sale, GST rate on jewellery making charges cut to 5 from 18 stocks jump up to 3 Industry News The Financial Express sale, GST on Gold GST Impact on Gold Making Charges GST Paisabazaar sale, GST ON GEMS AND JEWELLERY BUSINESS FAQs GST ON MAKING CHARGES IN CASE OF JEWELLERY CA CHETAN sale, GST on labour Charges Types Calculation HSN Code Contractors IIFL Finance sale, Impact of GST on Gold Everything you need to know b2b sale, The GST on gold ornaments is 3 of the total value of the gold jewellery. This includes both the value of the gold and any making charges. This rate is charged as a total of CGST and SGST which is sale, GST Pushes Jewellers in Dilemma Over Making Charges sale, GST rate on gold and making charges sale, GST on Gold Jewellery Goyal Mangal Company sale, GST on Gold coins making charges HSN code GST PORTAL INDIA sale, GST on Gold Jewellery Gold Jewellery GST GST on Making Charges of Gold Jewellery sale, Impact of GST On Gold Silver in India Goyal Mangal Company sale, GST on Gold Jewellery Making Charges 2022 Bizindigo sale, Gst on sale purchase of gold sale, Gst on gold sale jewellery making charges sale, GST On Gold in India in 2024 GST Rates on Gold Jewellery Purchases sale, GST on Gold Jewellery Making Charges 2022 Bizindigo sale, Gst rate on making charges of gold deals jewellery sale, GST Registration Effects of Gold GST Rate in India 2024 E Startup India sale, Product Info: Gst making charges sale.

-

Next Day Delivery by DPD

Find out more

Order by 9pm (excludes Public holidays)

$11.99

-

Express Delivery - 48 Hours

Find out more

Order by 9pm (excludes Public holidays)

$9.99

-

Standard Delivery $6.99 Find out more

Delivered within 3 - 7 days (excludes Public holidays).

-

Store Delivery $6.99 Find out more

Delivered to your chosen store within 3-7 days

Spend over $400 (excluding delivery charge) to get a $20 voucher to spend in-store -

International Delivery Find out more

International Delivery is available for this product. The cost and delivery time depend on the country.

You can now return your online order in a few easy steps. Select your preferred tracked returns service. We have print at home, paperless and collection options available.

You have 28 days to return your order from the date it’s delivered. Exclusions apply.

View our full Returns and Exchanges information.

Our extended Christmas returns policy runs from 28th October until 5th January 2025, all items purchased online during this time can be returned for a full refund.

Find similar items here:

Gst making charges sale

- gst making charges

- gst gold tax rate

- gst of gold

- gst of gold ornaments

- gst on 24k gold

- gst on buying gold

- gst in gold

- gst on gold 2019

- gst on gold

- gst on gold and silver